[ad_1]

What’s credit score, how does credit score work, and why is it vital? In relation to making huge purchases like shopping for a house or financing a enterprise, realizing and understanding your credit score is tremendous vital! Discover out all it is advisable to find out about credit score right here!

Your creditworthiness is used to find out your eligibility for “pay to make use of” providers like your mobile phone or your residence rental. It’s additionally used to find out your rate of interest on your bank cards and loans.

Some employers might even use your credit score report as a figuring out issue when contemplating you for a job! Given how vital your credit score is, let’s get into how credit score works.

What’s credit score and what makes up your rating?

Your credit score is actually your means to borrow cash within the type of a mortgage or bank card at a particular rate of interest based mostly in your previous borrowing and fee historical past. Your credit score rating is made up of a number of elements, together with historical past, funds, debt to credit score ratio, age of the debt and extra.

That mentioned, with a view to full reply the query, “how does credit score work?”, it’s vital to know extra about every of those various factors.

Credit score historical past size

Your size of credit score historical past is how lengthy you’ve had credit score for. For those who’ve had an account open for a few years, it’s normally higher in your credit score rating.

It clearly takes time to construct up a great credit score historical past size, so this isn’t one thing you possibly can instantly change. When you have no credit score in any respect, you can begin constructing the historical past size by opening an account.

Your credit score historical past is a compilation of all bank cards and loans you’ve ever had. All the best way again to that first bank card you signed up for in faculty with a view to get the free t-shirt (been there, executed that!).

In case you are new to constructing credit score, you might need an inadequate credit score historical past. However this may be remedied over time by mindfully making use of for credit score and paying your payments on time.

Credit score combine

There are loads of sorts of credit score, together with bank cards, mortgages, scholar loans, and many others. So, your credit score combine is how a lot of the various kinds of credit score you could have.

The Ascent from Motley Idiot explains that having a great credit score combine means a stability of each revolving and installment credit score.

Historical past of fee

Historical past of fee is a really huge issue that helps decide your general credit score rating. It’s how nicely you’ve paid again your money owed over time, and it accounts for 35% of FICO scores in addition to being vital for VantageScore, claims Forbes.

So, in case you’re questioning the place to begin with constructing good credit score, paying on time is an especially vital factor.

Credit score utilization (Debt to credit score ratio)

Credit score utilization is one other crucial factor for figuring out your credit score rating. It’s also referred to as your debt-to-credit ratio, and it’s basically how a lot you owe, divided by the quantity of obtainable credit score you could have. Utilizing greater than 30% of your out there credit score could make your rating drop.

So that you wish to watch out to not tackle any debt that you simply don’t must and repay your bank cards and loans as quickly as doable.

New credit score

Any new bank cards or loans can have an effect on your credit score. If a tough inquiry (when your credit score is checked for a mortgage or bank card) is made once you apply, it might have an effect on your rating.

Nevertheless, Bankrate explains that new credit score may have a optimistic affect if it improves your credit score combine or utilization.

So it’s vital to concentrate on how this will affect your rating earlier than you apply for something new.

Two sorts of credit score

So, how does credit score work on the subject of the sorts of credit score that exist? There are two primary sorts, known as revolving and installment credit score. Listed below are the small print.

1. Revolving credit score

Revolving credit score means that you can proceed to borrow cash on a revolving foundation, even if you’re at present paying the cash again. The most effective instance of this can be a bank card, which lets you make funds whereas concurrently utilizing the cardboard. However you should definitely discover ways to use bank cards properly.

Different examples of revolving credit score embrace house fairness strains of credit score and private strains of credit score.

2. Installment credit score

Installment credit score is a set sum of money that you simply borrow after which pay again over time. You’ll make funds on it constantly till the quantity is paid again. However you’ll pay again with curiosity.

A house mortgage is among the finest examples of an installment mortgage, and there are additionally scholar loans and different sorts of loans. Different examples of installment credit score embrace automobile loans and private loans.

How your credit score rating is calculated

So, how does credit score work on the subject of your credit score scores? Within the US, there are 3 main credit score bureaus: Equifax, Transunion, and Experian.

Their primary job is to gather your credit score data from varied sources, mixture them right into a report, assign you a credit score rating based mostly on their methodology, and make this data out there to your potential lenders.

You’re assigned a credit score rating, a quantity sometimes between 300 to round 850. Your credit score rating principally displays how nicely you’ve managed your bank cards and loans up to now. A great credit score rating is deemed as 700 and above.

There are two primary credit score scores utilized by these bureaus:

FICO rating

The FICO rating is the preferred scoring methodology. Elements used to calculate your FICO rating embrace fee historical past, debt owed, age of credit score, new credit score/inquiries, and sorts of credit score.

90% of the highest lenders use FICO scores. Rating vary: 300 to 850.

Fico scores are extraordinarily vital to contemplate, however there may be one other primary scoring methodology.

VantageScore

The VantageScore is one other scoring mannequin. It was created by the three main credit score bureaus.

Elements used to calculate your VantageScore embrace fee historical past, credit score utilization, sort of account and age, and credit score conduct. Rating vary: 300 to 850.

Professional tip: Credit score isn’t the whole lot

Your credit score rating does matter for lots of issues, for you as a borrower, from getting a mortgage to being authorized for a brand new bank card.

Nevertheless, it’s important to do not forget that your credit score rating is simply a part of your monetary image. There are different issues that matter simply as a lot, like saving, investing, and retirement planning.

In case you are attempting to construct your rating and it isn’t the place you’d prefer it to be, don’t fear. Concentrate on the issues you possibly can management by persevering with to decide on monetary wellness, and your credit score will finally enhance with this intentional motion.

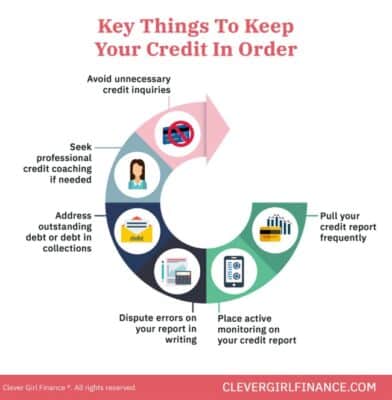

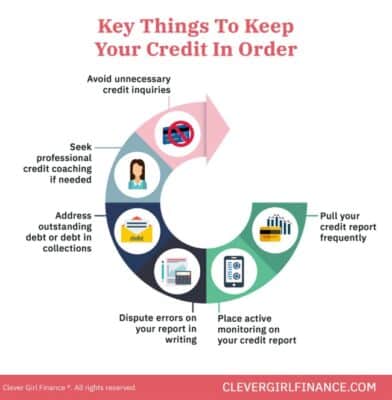

Key tricks to construct and keep your credit score

Now that you simply’ve answered how does credit score work, let’s deal with one of the best ways to construct credit score.

Constructing your credit score

It’s a wise concept to attempt to enhance your credit score rating as a lot as doable. It might probably provide help to getting the most effective rates of interest on loans, bank cards, and plenty of different sorts of debt.

Employers might even leverage your credit score rating as a part of their background checks relying on the function you’ve applies for. Right here’s what to do to make your credit score rating higher.

Perceive your present credit score standing

With the intention to enhance your credit score rating, it is advisable to know your present credit score standing. That is basically the start line on the subject of one of the best ways to construct credit score.

So, what’s your credit score rating? When was the final time you checked your credit score? Is the whole lot in your credit score report documented precisely?

Moreover, are you paying all of your payments on time? Are you conscious of any delinquencies?

You need to have the ability to reply all of those questions on your credit score at any time limit. Then, you’ll have a good suggestion about your credit score standing earlier than you apply for any loans.

Realizing your credit score rating and what’s in your credit score historical past will even make you conscious of credit score fraud or id theft of your private data. Then, you possibly can determine what to do in case your id is stolen.

It is extremely vital to catch this early as a result of in case you catch it too late and your credit score has already been broken, it may be a ache to repair.

Within the US, you might be entitled to a free copy of your credit score report from every of the three bureaus annually, in accordance with USA.gov. Take a look at your free credit score report at annualcreditreport.com.

It’s a good suggestion to acquire a replica of your present credit score report from all three credit score bureaus. In any case, you wish to know the place you at present stand together with your credit score.

It’s worthwhile to perceive what has been reported about you to the credit score bureaus. Which means data concerning your funds, how a lot you owe, your completely different account sorts, and any late funds or delinquencies.

Pay your payments and loans on time

Paying your payments on time is a giant a part of how credit score works. It proves your creditworthiness to lenders and has a huge effect in your credit score rating.

In case you are behind on any funds or have payments piling up, you must attempt your finest to catch up as quickly as you possibly can. Name your collectors to create fee plans and arrange new fee dates.

It’s additionally a good suggestion to set reminders for your self for all of your payments. Then you possibly can be sure to don’t overlook to make any funds sooner or later.

Construct all of your recurring funds (together with their due dates!) into your finances. Additionally, contemplate automating your funds.

Scale back your general debt-to-credit ratio

You are able to do this by paying down money owed and/or paying them off every month. Your general debt load, in addition to your proportion of credit score utilization, impacts your credit score rating. You may calculate your bank card utilization right here.

Let’s say you could have a bank card with a restrict of $1,000, and also you owe $950 on it; your utilization is 95%. Excessive utilization can depend in opposition to you as a result of collectors use it as a gauge to see how possible you might be to pay again what you owe.

It’s also possible to attempt to add to your credit score restrict and pay down debt on the similar time to make your debt-to-credit ratio smaller.

Don’t shut outdated accounts

So, how does credit score work on the subject of your outdated credit score accounts? Your bank card accounts make up a significant a part of your credit score historical past, so when you’ve got accounts that present you’ve been paying your payments on time constantly, you’ll wish to preserve them as a part of your credit score historical past.

When you have accounts you’ve paid off, preserve them open and make the occasional small buy on them. Pay them off in full every month.

Monitor your credit score

Many banks and bank card firms now present free up to date credit score scores in addition to every day credit score monitoring. It’s price wanting into these providers to remain on high of your credit score rating.

Sustaining your credit score rating

When you lastly get to a degree the place your credit score is nice, how do you make sure you keep there? By sustaining your rating. Right here’s how:

Repay and keep away from debt

Paying off debt exhibits your collectors that you’re financially accountable, and avoiding it as an entire (particularly bank cards) gives you fewer payments to pay every month. It would additionally can help you deal with what actually issues – constructing wealth.

So discover ways to repay bank cards quick and use your debit card for purchases.

Construct an emergency fund

Your emergency fund is actually your backup plan within the occasion the unplanned happens. Having one means you received’t need to depend on debt to resolve your state of affairs, which in flip means you possibly can preserve your credit score utilization ratio low.

Save for retirement

Similar to with having an emergency fund, over the long run, saving for retirement reduces and hopefully eliminates any reliance you could have on debt. A strong nest egg in your future self means you received’t must finance the prices of your life-style come retirement.

So contemplate completely different suggestions for retirement and begin planning.

Examine your credit score incessantly

Checking your credit score incessantly will inform you of what’s being reported, this manner, you possibly can take any mandatory actions to rectify inaccuracies in the event that they happen.

Apply a credit score freeze

It’s additionally a good suggestion to set up a credit score freeze that forestalls the opening of latest strains of credit score in your identify. It might probably assist shield you from credit score fraud. In case you are not making use of for a brand new line of credit score or mortgage anytime quickly, it’s undoubtedly one thing to contemplate.

Discover out extra concerning the course of in case you’re questioning, ought to I freeze my credit score?

These are all issues try to be doing over the long run. Establishing good monetary habits ensures you keep away from situations that may affect your credit score.

3 Frequent credit score myths

Now that we’ve gone over the query of what’s credit score, plus some methods to construct your credit score and keep in good standing, let’s dispel among the myths individuals generally consider about their credit score.

Having an intensive understanding of those incorrect assumptions will provide help to make sound monetary selections.

There are a variety of myths going round about how credit score works, together with:

Fable: Holding a bank card stability is nice in your credit score

Flawed! Carrying a stability isn’t an ideal concept. Not solely will you owe cash, however additionally, you will be paying curiosity.

Which means the value of no matter you paid for on credit score will price you extra money each month that you simply carry a stability.

You need to attempt to pay your bank card invoice in full and on time each month to construct and shield your credit score rating.

Fable: Checking your credit score report will cut back your credit score rating

In case you are making use of for loans or strains of credit score, there’ll possible be arduous inquiries made in your credit score report.

A tough inquiry for bank card purposes or credit score checks may cause a brief dip in your rating, however smooth inquiries akin to checking your credit score rating by credit score monitoring instruments won’t affect your rating.

Fable: As soon as a credit score rating is dangerous, it might’t be rebuilt

Your credit score will be rebuilt over time in case you deal with creating good credit score habits and dealing by the problems in your credit score report.

Issues like paying your payments on time and in full, coming to agreements with assortment companies for any accounts which can be delinquent, getting client credit score counseling or teaching, and many others., are all steps you possibly can take in direction of rebuilding your credit score.

What is a straightforward definition of credit score?

A easy definition of credit score is having the ability to borrow to pay for issues after which pay it again at a later time. So your bank cards and any loans you receive are all thought of credit score.

You should utilize credit score for a lot of good issues e.g. to buy an asset like a house that has the potential to understand. However that mentioned, since you are borrowing cash, it’s a potential debt that must be paid again, so you must use it with warning and with a plan.

What is an efficient credit score rating?

The overall consensus is that a good credit score rating is 700 or greater. With a credit score rating like this, you’ll possible get approval for a mortgage at a great rate of interest. A superb credit score rating, alternatively, is about 800 and better.

How does credit score construct up?

Credit score builds up over time and with good credit score conduct. Paying off your money owed on time, maintaining accounts open, your credit score combine, and different elements will help construct up your credit score.

It takes time and endurance to construct your rating, so don’t anticipate in a single day outcomes.

Nevertheless, you possibly can constantly take steps to enhance your rating and make good cash strikes.

Is credit score the cash you owe?

Credit score isn’t the cash you owe, it’s the quantity you possibly can borrow and might want to pay again. Credit score, nonetheless, has the potential to turn out to be cash you owe, however provided that you employ it.

As an illustration, when you’ve got a bank card which you could spend $5,000 on, then you could have $5,000 price of credit score. However in case you use a few of it, then there may be much less which you could borrow.

What builds your credit score rating probably the most?

Your fee historical past over time builds your credit score rating probably the most. That mentioned, there are a lot of elements that contribute to credit score.

Articles associated to one of the best ways to construct credit score

For those who loved studying about how credit score scores and credit score works, then you definitely’ll like these different weblog posts!

Studying how credit score works can profit you financially!

So, now that you understand how does credit score work, keep in mind you must use credit score properly and to your benefit. Which means utilizing it to acquire a house mortgage, get a mobile phone, signal a lease for an residence, or for enterprise financing (with a strong marketing strategy).

Don’t use it to rack up bank card debt, which, over the long run, is to your drawback. Be taught extra about constructing good credit score with our free course!

[ad_2]

Supply hyperlink